Since the beginning of this year, despite

experiencing a fluctuating tariff storm, the production base and sales area of

TV factories have already been appropriately matched. Overall, shipments from

TV contract manufacturers worldwide, including China, Mexico, and Vietnam, have

remained relatively stable and slightly increased.

According to data from RUNTO Technology,

within the statistical scope, the total shipment volume of top 10 professional

ODM factories in April 2025 increased by 2.4% compared to the same period last

year, and also increased by 4.1% compared to March, continuing the continuous

growth trend since the beginning of this year.

However, from January to April, the

year-on-year growth rates for each month ranged from a relatively low 1% to 7%.

This also reflects to some extent that the global TV terminal consumer market

is not very prosperous.

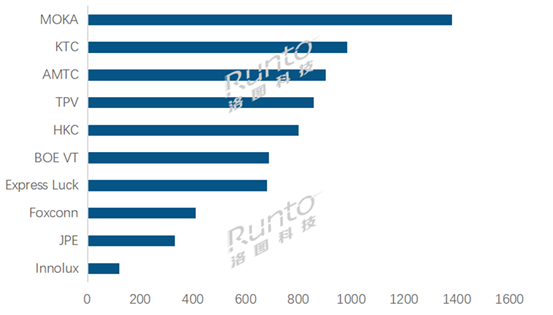

Among the 10 professional factories within

the statistical scope, six increased year-on-year and four decreased in April.

Among them, the growth rates of TPV (Crown), HKC (Huike), and BOE VT (Video)

exceeded 10%.

--MOKA shipped approximately 1.38 million

units in April, ranking first in the global TV contract manufacturing market

that month, with a year-on-year growth of 7.8%. Maojia has consistently

performed well in the market in recent years, with monthly shipments exceeding

one million units in the first four months of this year. As of April, the

cumulative shipments have increased by 12.4% compared to the same period in

2024. TCL Group's own brands have also performed well in the domestic market in

China. From January to April, the cumulative shipment of TCL series brands in

the Chinese television market was nearly 2.6 million units, ranking first in

the industry, with a significant increase of 20.2% compared to the same period

last year.

--KTC (Kangguan) shipped approximately 980K

units in April, rising from sixth in March to second in the ranking of

professional contract manufacturers, with a significant increase of 55.6%

compared to the previous month. The cumulative shipment volume from January to

April this year is close to 3 million units, an increase of 15.2% compared to

the same period last year.

--AMTC (Zhaochi) shipped approximately 900K

units in April, ranking third among professional contract manufacturers, with a

year-on-year increase of 1.3%. Its complete machine factory in Vietnam, which

mainly faces the North American market, has been in mass production for over a

year. In early April, it was slightly affected by "equivalent

tariffs", but after announcing a 90 day suspension of tariffs in the

United States, shipments returned to normal.

--TPV shipped approximately 860K units in

April, ranking fourth among professional contract manufacturers. As a former TV

contract manufacturer, we finally experienced a rare month on month growth in

April, with increases of 10.9% and 48.7% respectively. The increase mainly

comes from domestic main customers Hisense and Skyworth, both of which have

double-digit year-on-year growth rates; Meanwhile, overseas customer Element

has been shipping since the second half of last year, with a monthly shipment

volume exceeding 100K units. The combined shipment volume of self owned brands

Philips and AOC increased by 32.6% month on month in March, but still decreased

by 11.7% year-on-year.

--HKC (Huike) shipped approximately 800K

units in April, ranking fifth among professional contract manufacturers, with

year-on-year growth of 21.2% and 9.6%, respectively.

--BOE VT (Video) shipped approximately 690K

units in April, ranking sixth among professional contract manufacturers, with

year-on-year growth of 11.5% and 5.0% respectively. Domestic customers Xiaomi,

overseas customers Vizio, and LGE have made significant contributions.

--Express Luck shipped approximately 680K

units in April, ranking seventh among professional contract manufacturers, with

a year-on-year decrease of 15.1% and 20.9%, respectively.

--Foxconn shipped approximately 410K units

in April, ranking eighth among professional contract manufacturers. Although it

increased by 5.1% year-on-year, it decreased by 22.6% compared to the previous

month.

--Innolux ranks tenth in the professional

OEM series, with a monthly shipment of only 120K units, a significant decrease

of nearly 30% year-on-year, ranking among the top in terms of decline.